Can a Judge Force You to Sign a Quit Claim Deed

In club to transfer buying of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim human action, interspousal transfer deed, or a grant human activity, in order to convey the championship to the belongings.

In virtually cases and in most states, including California, a quitclaim deed form is going to exist the simplest fashion to accomplish this. Even so, signing a quitclaim act is an important step in the divorce settlement process and the consequences of signing this musical instrument prior to divorce should be carefully considered.

What is a quitclaim deed?

A quitclaim deed (often mistakenly referred to as a 'quick merits' deed) is a certificate that is used to transfer your interest in a property. Sometimes information technology's also called a non-warranty human activity.

With each quitclaim deed, there is a spouse that is labeled as the Grantor, and a spouse that is labeled equally the Grantee.

A Grantor is the ane transferring or conveying their interest in the property.

A Grantee is the one receiving the interest, or the spouse that has agreed to have buying of the property in their proper noun alone.

How is a quitclaim human action used in divorce?

In a divorce scenario, the grantor is usually the spouse parting the residence. They are also sometimes referred to every bit the "out-spouse". The grantee would be the spouse that agreed to retain the property on their own or the spouse that was awarded the property as function of the divorce settlement. This spouse is sometimes referred to equally the "in-spouse".

Spouses in divorce oftentimes use quitclaim deeds in real estate transfers. A quitclaim human activity does not have any warranties associated with it. In other words, they are not claiming anything about the holding itself – such as its status, value, equity, etc.

This deed simply transfers any interest the grantor has in the property over to the other person. With a quitclaim act, there is also no protection against debts and liens on the property. In the land of California, it's entirely possible that the grantor does not actually own the property, only has a community belongings involvement. We'll dive deeper into customs property in another article.

Who prepares the quitclaim human action form?

These deeds are bones documents that tin can be created on your own, or through your family law attorney, or through an escrow or title company.

A quitclaim deed is considered a legal certificate. As a effect, it is always appropriate to have a lawyer draft the human activity itself or to have them review it before you agree to execute it.

At that place are several templates available online through your County Clerks website that will permit yous to make full out, print and file the human action on your own.

Here is what a quitclaim deed should wait like:

Some title companies won't be able to issue a new title insurance policy unless the quitclaim deed was completed the right way and is considered insurable. When a title to real property is insurable, it means that the title is clear and gratis of any blemishes. In short, this allows the grantee the take whatsoever steps they want in the hereafter to finance or sell the property.

A human activity that was drafted on your own without the assist of an attorney or an escrow company may be accounted uninsurable. If this is the instance, the original grantor would need to sign a new deed to get in enforceable. This poses some unique challenges in a divorce situation as i could imagine.

In some instances, the grantor tin sign an Uninsured Human activity Affidavit to verify that they did truly transferred their interest in the property. Only at this point would the retaining spouse be able to obtain a new, clean title insurance policy to protect against the clouded title. Again, in a divorce setting going back to an ex-spouse to resign a deed affidavit isn't always as like shooting fish in a barrel equally one would hope.

For this reason alone, information technology is imperative that deeds are prepared properly, signed properly, and recorded properly.

Why would I need to sign a quitclaim deed?

Every bit we just discussed, divorce settlements usually effect in one spouse retaining the marital home. The spouse that does not retain the property volition likely need to execute a quitclaim deed.

A quitclaim human action will remove the out-spouse (or departing spouse) from the championship to the property, finer relinquishing their disinterestedness or ownership in the home. The execution of a quitclaim act is typically a requirement of a divorce settlement in gild to consummate the division of assets.

The parting spouse'south involvement in the property is probable to be converted to greenbacks via a property buyout, or it can be offset by other community assets that will be retained in lieu of the marital dwelling house.

It is presumed that the spouse conveying the property via quitclaim deed has some level of community involvement to give upwardly.

Does a quitclaim deed affect the mortgage?

Information technology is a mutual misconception that signing a quitclaim deed will reach BOTH of the following:

- Remove spouse from the title, AND

- Remove spouse from the mortgage. This is the furthest thing from the truth.

In fact, a quitclaim deed and transfer of ownership have no impact whatsoever to the condition of the existing mortgage.

If the existing mortgage is a joint obligation in both spouse'due south names, then that loan volition either demand to be refinanced or assumed by the retaining spouse in order for the debt to be removed from your credit study.

The quitclaim human action lonely does non affect the joint buying of this lien. If your name remains on the mortgage after yous've quitclaimed your ownership in the property, any lender tin can still hold you accountable for the mortgage payments in the event a payment is missed.

Can I (or my spouse) decline to sign a quitclaim deed during a divorce?

A quitclaim deed doesn't always need to exist signed before the divorce is final.

Your divorce judgment will detail the terms of your holding settlement agreement, and the requirement for transferring championship will likely be incorporated into this understanding.

Prior to this becoming a legal requirement, information technology is hard to forcefulness a spouse to sign this human action before the divorce. Presumably, in that location are other issues surrounding the divorce that accept yet to be resolved. If a spouse has fears that they will lose leverage in their divorce negotiations, or they are unhappy with the existing buyout terms, that spouse should (in virtually cases) shy away from conveying their involvement likewise soon in the divorce procedure.

You can protect yourself by merely transferring ownership once all of the avails have been divided fairly.

Can I (or my ex-spouse) refuse to sign a quitclaim deed after a divorce?

One time the divorce judgment has been entered and there is a legal requirement for you to execute a quitclaim deed, y'all could be held in contempt by refusing to sign.

The judge does have the option of assigning a court-ordered quitclaim deed, which has the same consequence of transferring buying without you ever signing a deed. In other words, you tin't skirt your legal obligation to sign the deed simply past refusing to do so. Again, your divorce settlement is a legally binding contract and is otherwise fully enforceable by the courts.

The process and laws for these court-ordered deeds tin vary from country to state, although they are an accustomed practice in the state of California. It should be noted that the process for getting a judge to do this tin can exist either fast or slow, depending on the urgency and the courts capacity for these requests.

Can a quitclaim act filing exist reversed?

Once yous sign a quitclaim deed and it has been filed and recorded with the County Clerks Function, the title has been officially transferred and cannot be easily reversed.

In order to reverse this type of transfer, it would require your spouse to cooperate and aid in adding your name back to the title. This is not an easy assignment.

The courts would need to get involved if you felt this human activity was signed nether duress, or if you did not receive the valuable consideration that was a condition of your transferring the property. This highlights the need for conscientious thought and consideration before executing such an instrument as the quitclaim deed.

The legal ramifications of a quitclaim act and its affect on community property claims will vary country to state.

How does a quitclaim act touch on property taxes?

In that location are two potential tax consequences of signing a quitclaim deed in a divorce.

- Transfer taxes (both City transfer taxes, and County transfer taxes)

- Property Tax Assessment, or Property Tax Basis

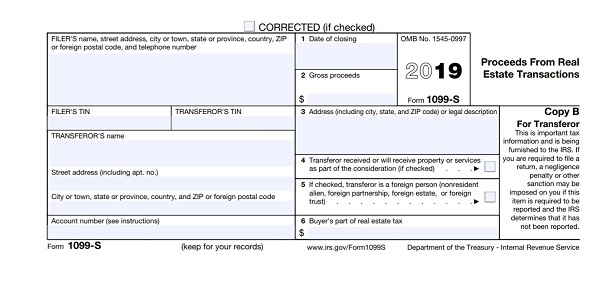

- Uppercase Gains Tax via 1099-Southward

Simply put, taxation laws vary from state to country.

In fact, Metropolis and County taxation laws surrounding transfer taxes volition too vary past the specific City & Canton. In California, in that location are typically no transfer taxes for the conveyance of real property pursuant to a divorce settlement understanding.

In add-on, at that place is usually no impact to your property tax basis for ownership out your spouse'southward interest in the home and transferring title to your name every bit an individual. Information technology'due south worth noting that while this transfer doesn't trigger a reassessment, that'due south not to say that your property will NEVER be reassessed in general.

The third tax component of these transfers is a 1099-S that a title company would issue to the Grantor for their 'gain' on the auction of their interest.

Beneath is a re-create of what a 1099-S looks like.

As your CPA or tax professional can advise you; while y'all may receive a 1099-S, this transfer pursuant to a divorce settlement is a non-taxable event. Yous would still annotation the 1099-S earnings to the IRS, however, these earnings would then be excluded.

Divorce Mortgage Advisors does non provide tax or legal communication and we always propose you speak to a professional person in either of those areas for guidance specific to your scenario.

Source: https://www.divorcemortgageadvisors.com/quitclaim-deed-divorce/

0 Response to "Can a Judge Force You to Sign a Quit Claim Deed"

Post a Comment